|

While reading blogs, articles and books written by people that have retired early I noticed philanthropy is a common theme. Most of us need to be useful, and in the case of those that have become fantastically wealthy such as Bill Gates, it's nearly physically impossible to spend money as fast as they make it. In general they do not have a specific suggestion about how much to give, and leave it up to the reader to work out once retired. Which makes sense, there will be more free time to reflect every week!

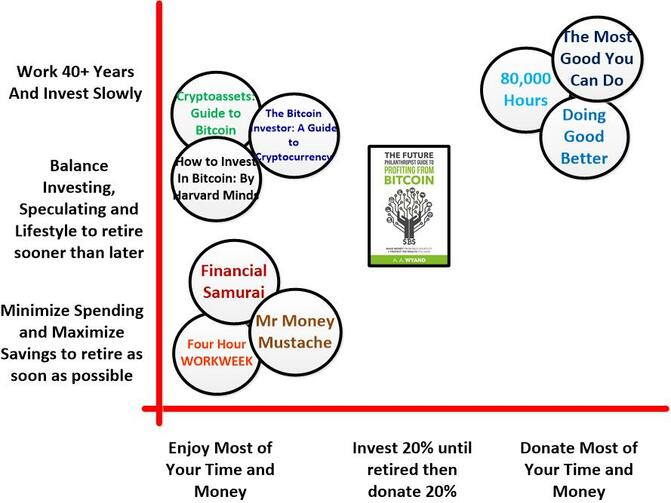

The Investment books (bitcoin, real estate, and whatever) tend to be laser focused on that one asset. Which makes sense, you want to learn more about that one topic. What might be different about bitcoin is the simplicity from an investors point of view. Either it will continue to make people millionaires and billionaires, or not. If not, there isn't much to say. If it does, then what? The average person in the developed world has a better life than most people in history, or even most people living today around the globe. There is a good moral case that those lucky to be born in North America or Europe should do all they can to help those on less fortunate continents, and even those less fortunate within our cities and towns. With better access to information and models we can not only give much more, we can give much more effectively. My success as an engineer has been to take the best theory and data available at a given moment, and apply it to real world problems in a pragmatic way. A common saying is that "The perfect is the enemy of the good". It might take centuries to get something to 99.9999% purity, why not get it to 99% today, make some profit and when the benefits of 99.9% are on the horizon work on that then. This book takes a pragmatic best from these three. The financial independence/ retire early (FIRE) movement advocates spending much less and investing much more to minimize the years you work. A more pragmatic approach is to invest 20%, live within your means, and retire earlier than most. The Effective Altruists might prefer for you to do important work and give away as much as you can, perhaps and until you die or need charity yourself. A more pragmatic approach is to set a larger than average philanthropic goal for retirement. If you are already investing 20% of your income and living within your means, then when you no longer need to work you can give this much away instead of investing it. Many philanthropic millionaires give less than 2%. 20% is relatively far more generous, even if it is far less than the most generous people give. The most popular, and the majority, of bitcoin books are written for finance or technology people that want a deep dive on this historic new kind of asset. All of that is well and good for them, but the majority of people only need to know a few key fundamentals. Just as most people that have bought a stock are aware they this is a share of a company and can enter the symbol and click buy with their brokers website. We do not need a degree in finance to understand every word in every annual report, nor do we need to understand the layers of market makers and exchanges that convert the "buy" mouse click into a new holding in our portfolio. The bulk of my book is dedicated to the steps in deciding how large a "bet" to place on bitcoin consider the risk and opportunity, and your situation. Then some pragmatic steps to make a purchase, manage the holding, and sell to lock in profits. My hope is that setting achievable goals using straightforward steps will encourage many more people to go for it and succeed! What do you think? Please leave a comment or email [email protected]

1 Comment

Why do many of us work hard for decades so we can suddenly stop when we are are frail? Does a lack of effort, purpose and mental challenge increase frailty?

The Financial Independence / Retire Early (FIRE) movement has a similar goal and solves part of the problem. If you can minimize your spending to invest more, you can reach the retirement goal much younger. Does this lead to increased frailty, anecdotally I think it does to some degree. An alternative option would be to plan to continue working some amount forever. Perhaps longer vacations and fewer hours per week. Perhaps as your own boss with flexible hours. Lowering expenses would still be important, after all, even someone making a million a year can find a lifestyle of luxury that makes this a necessity. If your retirement funds can meet your basic expenses, then income from work can go towards luxuries and philanthropy. |

AuthorA.A. Wyand Archives

January 2020

Categories |

RSS Feed

RSS Feed