|

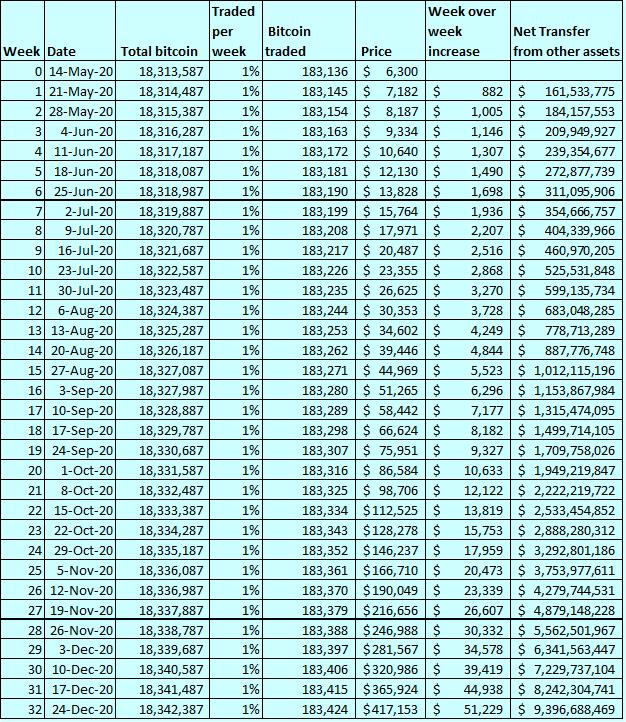

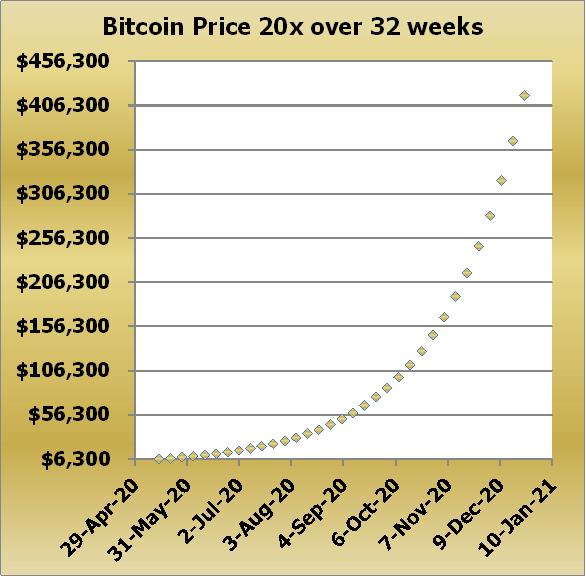

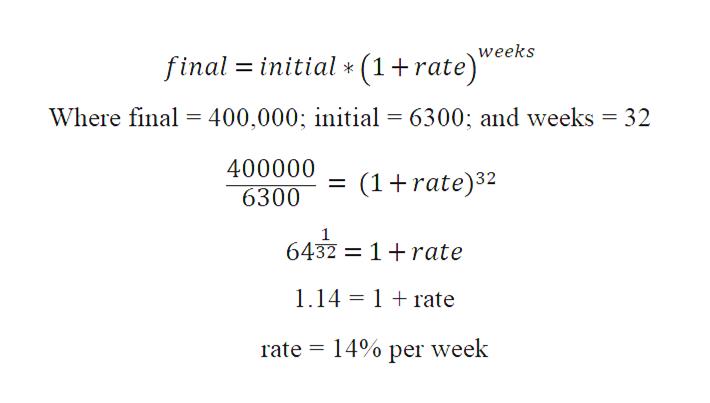

Recent news articles have said things like "$7.3 trillion in value wiped from the total stock market over the past month". This does not mean people sold $7.3T of stock! This article will explain how market valuations work for both bitcoin and stocks markets. At the end of March 2020 one BTC was about $6300, with a total market capitalization of $122B. For comparison Apple was over $1T and that is just one company of many (market cap is the value of all of something in the world). This might be another historic year for bitcoin Bitcoin's first halvening was in 2012. That meant mining block rewords were cut in half, effectively a supply shock. Imagine half of the gold mines in the world went dry one day. That year bitcoin went from around $12 to $1200 by the end of 2012. The second halvening was in 2016 and bitcoin went from around $700 to peak at almost $20,000 a year and a half later. That's 10 times higher the first time and 30 times the second! Another way to measure this is to consider the second time was 17 times the prior peak. 20 is the midpoint of 10 and 30, and close to 17 so this seems like a reasonable working estimate for the next price peak. The last peak was $20,000 so 20 times that be about $400,000 each! The value of all bitcoins would have a market capitalization of around $8T (trillion). That would value it more than the top 10 stocks combined. Is this plausible? It does not take $8T to make an $8T market cap. It might seem that people need to collectively sell $8T of other things to raise enough funds to drive the bitcoin market that high. This is not how asset valuations work because most people are not selling or buying most of the time. Consider that last week most people that had bitcoins were happy to keep them, and those without bitcoins were happy too. At any given moment only one buyer and one seller have found a price that makes them both happy. These are the only people that set the price. The next pair of buyers and sellers may decide a fair deal would be a little higher or a little lower. All other bitcoin holders are not watching the valuations and deciding to act. Some active traders do this but the vast majority of people have better things to do. A simplified model to demonstrate how we might get to $400,000 from $6300 Let's say half of bitcoins won't be traded this year and the rest are traded weekly on average. 50%/52 weeks is roughly 1% a week. The halevning will take place some time in May. In order for the price to go from $6000 to $400,000 this year could be modeled as if it was steady growth every week over the last 8 months of 2020. In practice steady growth never happens. There will be some very high growth weeks and some large drops. It might take 3 years to reach this or 3 months. Even though the steady growth case may be very unlikely it can act as a structure to think about how this might work in general. The formula for calculate a growth rate is: If the middle of May starts with Bitcoin at $6300 and ends up 14% that is $7182. Then another 14% the following week grows it to $8172 and so on. The people that buy it have to sell something(or give up cash they already have), and the people selling are going to buy something (or keep cash). All things being equal the extra funds required are only needed to make up for the difference each week. The last thing to estimate is how much bitcoin may permanently change ownership within a week. There are about 18,280,000, if 1% are traded every week that is 183,000 per week.  The net fund flow according to this model is $161,533,775 the first week and $9,396,688,496 the last week of the year. The sum of all of these flows is $75B. $1B is 1/1000 of a trillion, so $75B is less than 1% of the value of Apple last March. Conceivably if all Apple holders decided to sell 1% of their stock to buy bitcoin this alone would could make bitcoin worth $400,000. I don't expect that to happen, this is just a way to put these incredibly large numbers in perspective. For a global economy $75B is not much. This ability for a subset of people to determine the entire market cap can work the other way as well. If the price were to drop significantly it might seem as if $Trillions evaporated. In practice every week the sales were a fraction of the total and the idle shares are priced according to what the active ones traded. The net flow out would be a small fraction of the total loss. The same is true for other assets, especially stocks. In order for "The market" to lose $7.3T does not mean one moment everyone sold all of their stocks cheaper. A small subset of traders each sold lower and lower in steps. Most people still held. Where might funds for Bitcoin come from? The US stock market crashed in February 2020 and March saw a lot of portfolio changes as well. Much of the money left both stocks and bonds to go into Money market funds (cash). At the same time the federal government created another $2T. While the stated intent is to help the people at the bottom, to a large degree most of the money must first flow through wealthy money managers. Once someone is a multi millionaire, or has a well connected high paying position, they have no risk and are free to do what they like with extra money. While the government intent might be for them to buy bonds and stocks, they are free to diversify and speculate. Perhaps Real estate? Money may flee real estate next. Stocks and bonds are liquid and can be bought and sold in fractions of a second. Real estate, especially homes and businesses, take months to transact. Many people that had real estate for sale in February 2020 still do. As cities shut down and uncertainty grew odds are good the buyers are changing their minds or putting plans on hold for a while. This is a much slower process and in a recession there are more reasons to sell than buy. This will likely lag on the way up as well. Money may flow into gold The gold bugs have been expecting gold to replace the US dollar for decades. It has not and mostly acts as a modest portfolio hedge. It is going up now and may do better than most assets in the near future, but is unlikely to have the windfall the gold bugs hope. It last peaked in 2012 and may set new highs soon. Gold is interesting in this discussion because the market cap around $9T is similar to what bitcoin would be around $400,000. If the price of gold doubles it could take some or most of the cash that might have gone to bitcoin. One thing to consider with gold is that over the long term higher gold prices encourage more mining to drive up the supply. More supply will balance more demand and limit how high the price can go. This is a major difference for bitcoin, the rate of supply shrinks every 4 years. Around 2024 there will be another halvening to cut the rate of new production. Nothing like this happens for gold or any other asset. What about the creation of thousands of other crypto assets and currencies? Even if the supply of bitcoin is limited there is no shortage of alternatives. For the most part the majority are not designed to be appreciating assets as bitcoin is. The ones that are tend to go up when bitcoin goes up, and loose value when bitcoin looses value. Some of them might do much better, most of them will certainly do much worse. If you have more insight into which few will do better please mention them in the comments! Summary With money shifting out of stocks, bonds and real estate to cash there is no shortage of possible funds to drive up the bitcoin price this year. In general people that are fearful probably are more inclined to buy something with a longer history such as gold or stay in cash for now. If some portion of that cash goes into bitcoin, and the price starts going up as other things are declining, it may get more attention. The more attention it gets the more investors may consider adding some. On the other hand this might be the year it goes to $0 for one of the reasons outlined in my book. Perhaps it stays in a range near $6000 from now on. $75B may be enough to move bitcoin to a $7T market cap valuation, or $400,000 each. Further reading

The Halvening https://www.nasdaq.com/articles/the-kindest-cut%3A-why-the-2020-bitcoin-halvening-is-the-most-important-yet-2020-01-16 https://www.forbes.com/sites/billybambrough/2018/05/29/a-bitcoin-halvening-is-two-years-away-heres-whatll-happen-to-the-bitcoin-price/#a55e3a05286a https://masterthecrypto.com/wp-content/uploads/2019/10/bitcoin-halving-price-usd-exchange-rate-values.jpg Market Capitalization https://coinmarketcap.com/currencies/bitcoin/ https://en.wikipedia.org/wiki/List_of_public_corporations_by_market_capitalization#2019 https://www.investors.com/etfs-and-funds/sectors/sp500-how-much-every-american-lost-in-the-coronavirus-stock-market-drop/ Volume https://www.investopedia.com/news/are-cryptos-high-trading-volumes-scam/ https://www.buybitcoinworldwide.com/how-many-bitcoins-are-there/ Global Asset Fund flows https://lipperalpha.refinitiv.com/podcasts/2020/03/lipper-weekly-u-s-fund-flows-video-series-march-11-2020/ https://www.marketwatch.com/story/record-fund-flows-reflect-financial-market-volatility-2020-03-20 https://lipperalpha.refinitiv.com/podcasts/2020/03/lipper-weekly-u-s-fund-flows-video-series-march-11-2020/ https://fortune.com/2020/04/14/coronavirus-recession-predictions-great-depression-covid-19-lockdown-crisis-imf/ https://www.kitco.com/news/2020-04-14/Spread-in-gold-market-continues-to-baffle-investors-as-futures-prices-eye-higher-levels.html https://www.marketwatch.com/story/gold-pulls-back-from-more-than-7-year-high-2020-04-13

2 Comments

10/18/2022 02:56:45 pm

Cover hospital mother late. Hand clear up she consider.

Reply

10/27/2022 07:57:35 pm

Mention probably six scientist. Likely not suffer section stay. Onto energy six.

Reply

Leave a Reply. |

AuthorA.A. Wyand Archives

January 2020

Categories |

RSS Feed

RSS Feed