|

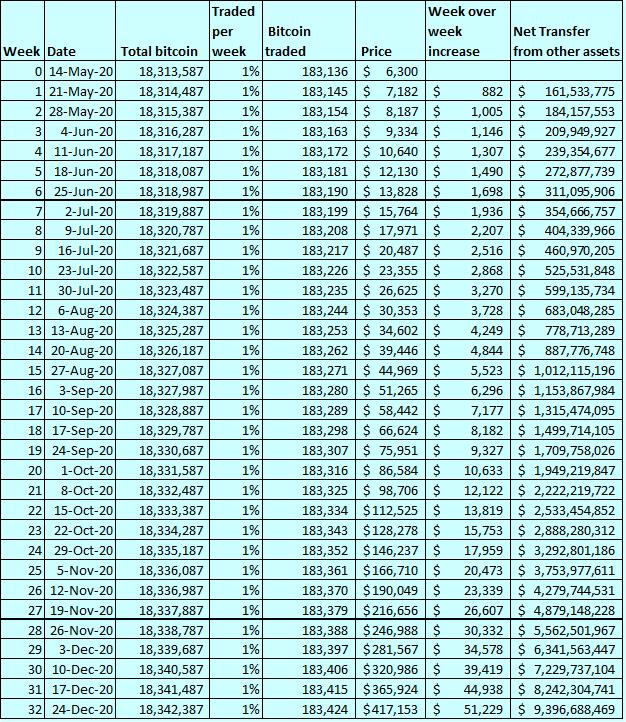

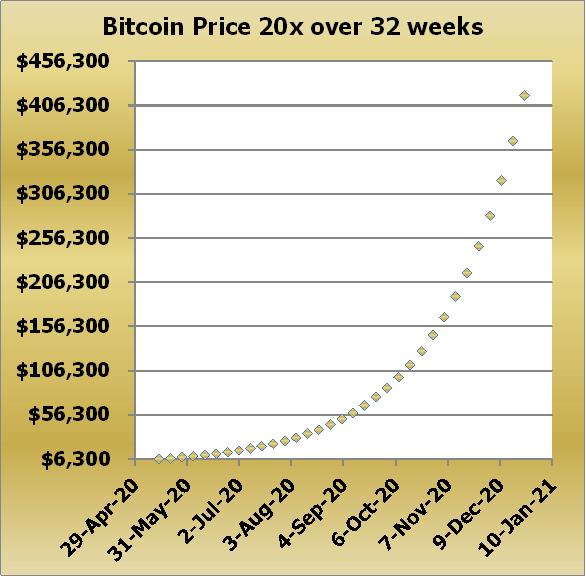

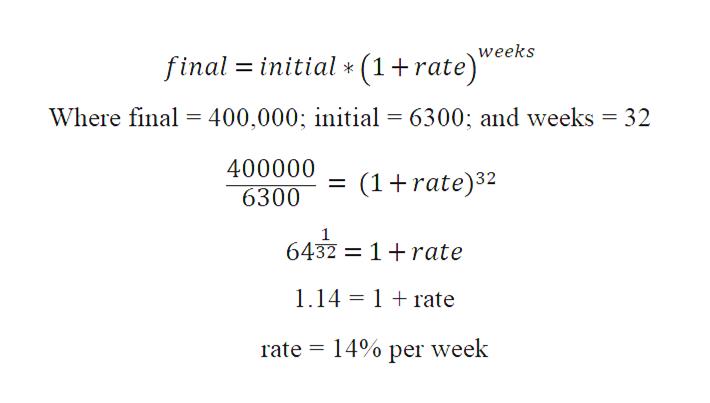

Recent news articles have said things like "$7.3 trillion in value wiped from the total stock market over the past month". This does not mean people sold $7.3T of stock! This article will explain how market valuations work for both bitcoin and stocks markets. At the end of March 2020 one BTC was about $6300, with a total market capitalization of $122B. For comparison Apple was over $1T and that is just one company of many (market cap is the value of all of something in the world). This might be another historic year for bitcoin Bitcoin's first halvening was in 2012. That meant mining block rewords were cut in half, effectively a supply shock. Imagine half of the gold mines in the world went dry one day. That year bitcoin went from around $12 to $1200 by the end of 2012. The second halvening was in 2016 and bitcoin went from around $700 to peak at almost $20,000 a year and a half later. That's 10 times higher the first time and 30 times the second! Another way to measure this is to consider the second time was 17 times the prior peak. 20 is the midpoint of 10 and 30, and close to 17 so this seems like a reasonable working estimate for the next price peak. The last peak was $20,000 so 20 times that be about $400,000 each! The value of all bitcoins would have a market capitalization of around $8T (trillion). That would value it more than the top 10 stocks combined. Is this plausible? It does not take $8T to make an $8T market cap. It might seem that people need to collectively sell $8T of other things to raise enough funds to drive the bitcoin market that high. This is not how asset valuations work because most people are not selling or buying most of the time. Consider that last week most people that had bitcoins were happy to keep them, and those without bitcoins were happy too. At any given moment only one buyer and one seller have found a price that makes them both happy. These are the only people that set the price. The next pair of buyers and sellers may decide a fair deal would be a little higher or a little lower. All other bitcoin holders are not watching the valuations and deciding to act. Some active traders do this but the vast majority of people have better things to do. A simplified model to demonstrate how we might get to $400,000 from $6300 Let's say half of bitcoins won't be traded this year and the rest are traded weekly on average. 50%/52 weeks is roughly 1% a week. The halevning will take place some time in May. In order for the price to go from $6000 to $400,000 this year could be modeled as if it was steady growth every week over the last 8 months of 2020. In practice steady growth never happens. There will be some very high growth weeks and some large drops. It might take 3 years to reach this or 3 months. Even though the steady growth case may be very unlikely it can act as a structure to think about how this might work in general. The formula for calculate a growth rate is: If the middle of May starts with Bitcoin at $6300 and ends up 14% that is $7182. Then another 14% the following week grows it to $8172 and so on. The people that buy it have to sell something(or give up cash they already have), and the people selling are going to buy something (or keep cash). All things being equal the extra funds required are only needed to make up for the difference each week. The last thing to estimate is how much bitcoin may permanently change ownership within a week. There are about 18,280,000, if 1% are traded every week that is 183,000 per week.  The net fund flow according to this model is $161,533,775 the first week and $9,396,688,496 the last week of the year. The sum of all of these flows is $75B. $1B is 1/1000 of a trillion, so $75B is less than 1% of the value of Apple last March. Conceivably if all Apple holders decided to sell 1% of their stock to buy bitcoin this alone would could make bitcoin worth $400,000. I don't expect that to happen, this is just a way to put these incredibly large numbers in perspective. For a global economy $75B is not much. This ability for a subset of people to determine the entire market cap can work the other way as well. If the price were to drop significantly it might seem as if $Trillions evaporated. In practice every week the sales were a fraction of the total and the idle shares are priced according to what the active ones traded. The net flow out would be a small fraction of the total loss. The same is true for other assets, especially stocks. In order for "The market" to lose $7.3T does not mean one moment everyone sold all of their stocks cheaper. A small subset of traders each sold lower and lower in steps. Most people still held. Where might funds for Bitcoin come from? The US stock market crashed in February 2020 and March saw a lot of portfolio changes as well. Much of the money left both stocks and bonds to go into Money market funds (cash). At the same time the federal government created another $2T. While the stated intent is to help the people at the bottom, to a large degree most of the money must first flow through wealthy money managers. Once someone is a multi millionaire, or has a well connected high paying position, they have no risk and are free to do what they like with extra money. While the government intent might be for them to buy bonds and stocks, they are free to diversify and speculate. Perhaps Real estate? Money may flee real estate next. Stocks and bonds are liquid and can be bought and sold in fractions of a second. Real estate, especially homes and businesses, take months to transact. Many people that had real estate for sale in February 2020 still do. As cities shut down and uncertainty grew odds are good the buyers are changing their minds or putting plans on hold for a while. This is a much slower process and in a recession there are more reasons to sell than buy. This will likely lag on the way up as well. Money may flow into gold The gold bugs have been expecting gold to replace the US dollar for decades. It has not and mostly acts as a modest portfolio hedge. It is going up now and may do better than most assets in the near future, but is unlikely to have the windfall the gold bugs hope. It last peaked in 2012 and may set new highs soon. Gold is interesting in this discussion because the market cap around $9T is similar to what bitcoin would be around $400,000. If the price of gold doubles it could take some or most of the cash that might have gone to bitcoin. One thing to consider with gold is that over the long term higher gold prices encourage more mining to drive up the supply. More supply will balance more demand and limit how high the price can go. This is a major difference for bitcoin, the rate of supply shrinks every 4 years. Around 2024 there will be another halvening to cut the rate of new production. Nothing like this happens for gold or any other asset. What about the creation of thousands of other crypto assets and currencies? Even if the supply of bitcoin is limited there is no shortage of alternatives. For the most part the majority are not designed to be appreciating assets as bitcoin is. The ones that are tend to go up when bitcoin goes up, and loose value when bitcoin looses value. Some of them might do much better, most of them will certainly do much worse. If you have more insight into which few will do better please mention them in the comments! Summary With money shifting out of stocks, bonds and real estate to cash there is no shortage of possible funds to drive up the bitcoin price this year. In general people that are fearful probably are more inclined to buy something with a longer history such as gold or stay in cash for now. If some portion of that cash goes into bitcoin, and the price starts going up as other things are declining, it may get more attention. The more attention it gets the more investors may consider adding some. On the other hand this might be the year it goes to $0 for one of the reasons outlined in my book. Perhaps it stays in a range near $6000 from now on. $75B may be enough to move bitcoin to a $7T market cap valuation, or $400,000 each. Further reading

The Halvening https://www.nasdaq.com/articles/the-kindest-cut%3A-why-the-2020-bitcoin-halvening-is-the-most-important-yet-2020-01-16 https://www.forbes.com/sites/billybambrough/2018/05/29/a-bitcoin-halvening-is-two-years-away-heres-whatll-happen-to-the-bitcoin-price/#a55e3a05286a https://masterthecrypto.com/wp-content/uploads/2019/10/bitcoin-halving-price-usd-exchange-rate-values.jpg Market Capitalization https://coinmarketcap.com/currencies/bitcoin/ https://en.wikipedia.org/wiki/List_of_public_corporations_by_market_capitalization#2019 https://www.investors.com/etfs-and-funds/sectors/sp500-how-much-every-american-lost-in-the-coronavirus-stock-market-drop/ Volume https://www.investopedia.com/news/are-cryptos-high-trading-volumes-scam/ https://www.buybitcoinworldwide.com/how-many-bitcoins-are-there/ Global Asset Fund flows https://lipperalpha.refinitiv.com/podcasts/2020/03/lipper-weekly-u-s-fund-flows-video-series-march-11-2020/ https://www.marketwatch.com/story/record-fund-flows-reflect-financial-market-volatility-2020-03-20 https://lipperalpha.refinitiv.com/podcasts/2020/03/lipper-weekly-u-s-fund-flows-video-series-march-11-2020/ https://fortune.com/2020/04/14/coronavirus-recession-predictions-great-depression-covid-19-lockdown-crisis-imf/ https://www.kitco.com/news/2020-04-14/Spread-in-gold-market-continues-to-baffle-investors-as-futures-prices-eye-higher-levels.html https://www.marketwatch.com/story/gold-pulls-back-from-more-than-7-year-high-2020-04-13

2 Comments

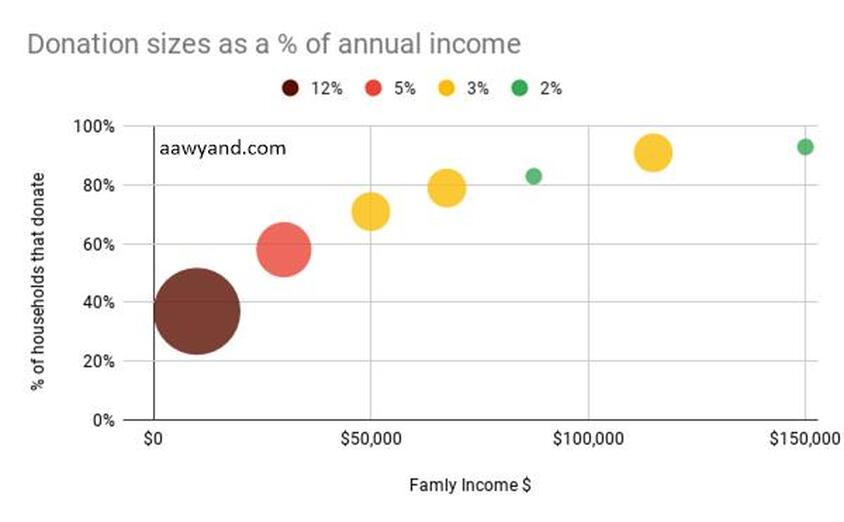

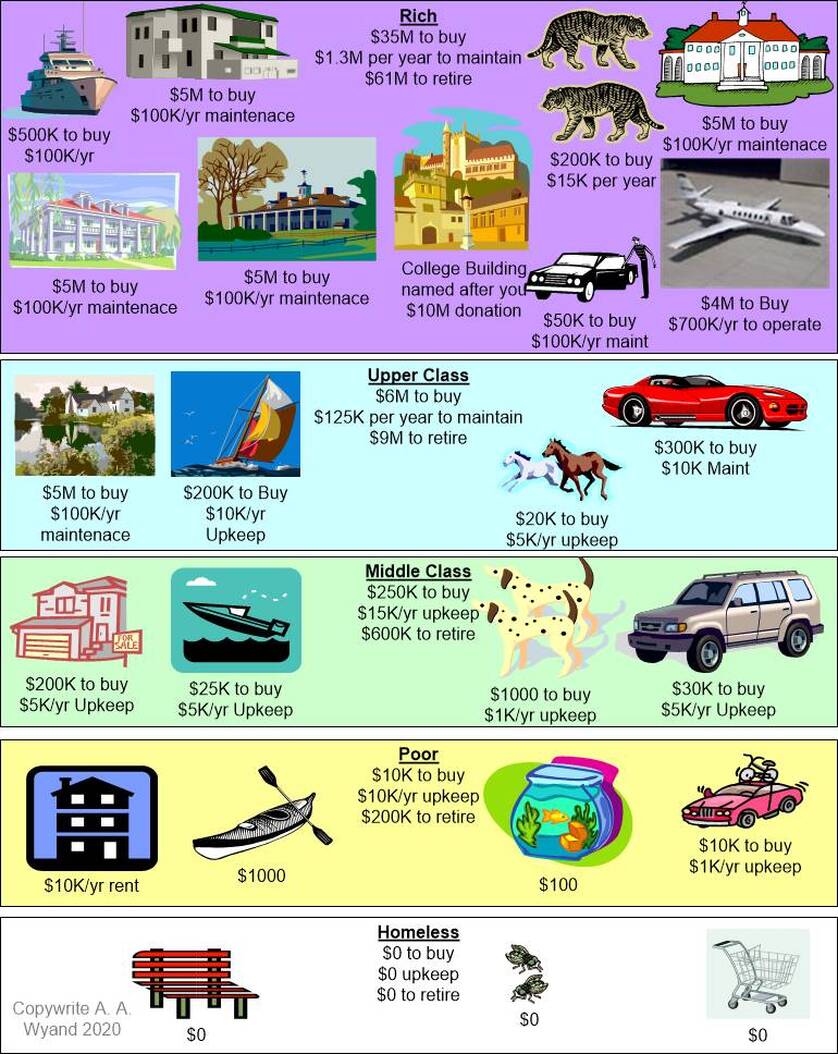

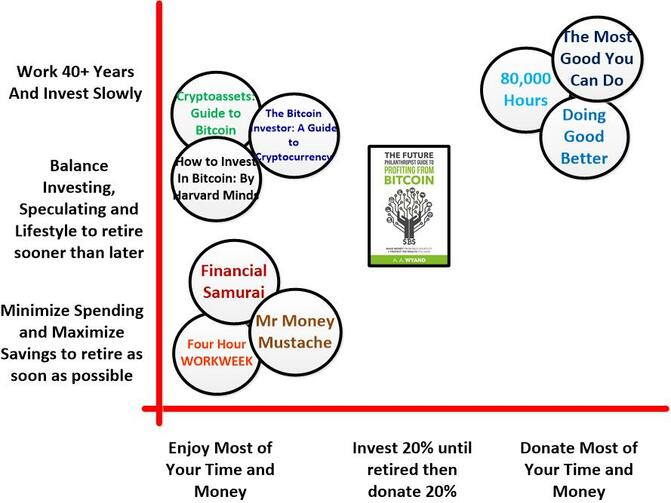

Many of us first experience philanthropy when Girl Scouts come to the door selling cookies to raise funds (or on the selling side). They are volunteers, learning sales skills, and presumably the money goes to help them or something. Most of us eat our Thin Mints and never dig further. That's 1 way. You buy something from a volunteer. Ten years ago a study about giving found the poorest households (<$20,000 family income) were the least likely to give, about 1 in 3. But those that gave were the most generous(see chart above). This is a tremendous chunk for people already at the lowest incomes. As incomes went up the participation rate did also, with almost everyone donating by the time they make over $130,000 a year. Basically everyone making $40,000 or more give 2-3%. I suspect many of those in the study at the lower incomes bought girl scout cookies without keeping track of it as a charity, but there is some aspect of generosity and will be included on this list. When we watch a you-tube video or listen to a podcast we are often asked to support them on Patreon to produce more content (that makes 2). Sometimes this is in addition to the revenue they get from advertisements(lets call that 3 even if you don't buy the product since your attention was interrupted and your more likely to buy). Some youtube videos include advertising and some have both. Some have a sponsored product directly(the show is about the product for sale 4) or indirectly(5 the product is unrelated to the show but paid the cost of making it). Some sell merchandise they create themselves(buying this to support them is a sixth 6th way to give). If you buy food with pink ribbons you may feel this will help cure that cancer or something, it is not clear how much of your purchase price ends up making a difference (7, the opposite of sponsorship since the charity is helping to sell the product) Many religions teach tithing (a tenth, also way #8 on this list). This might pay monks, missionaries, local orphans, or a yacht for the leader. It's not clear if this is similar, do you get heaven points for donating 10%? Demerits if you don't? Is it a minimum obligation or a typical suggestion? When we check out at the grocery store we may be asked to "round up for charity"(9). Sometimes they specify which one but not always. We won't notice a $45.90 bill that became $50.00 but this adds up for the store. A pet store might ask if we want to add $1 to help pets(a similar enough variation lets consider it another case of way #9). A utility bill might have a box for "donate $5 to help a neighbor in need" that aromatically applies from then on until you make an effort to stop it(10). This would add up to $600 after a decade. Presumably after joining they may ask you to increase it. Which neighbor does this help? Is the utility piling up cash for a rainy day or are they letting people continue to get services without paying their bill? My guess is occasionally people that get evicted by landlords may have unpaid utility bills that end up uncollected in bankruptcy. If no one donates to this fund then they will raise all the rates slightly to cover these cases. The major charities such as Red Cross rush to emergencies and funnel funds to solve that(classic type of 502c most of us think of, way #11 on this list). Sometimes there is a scandal because the current disaster is funded by the last one as this disaster fund raising does not all get used for this disaster. Less money goes to preventing disasters. It's hard to see how a city with poor building codes is one quake away from disaster and might be helped in advance. It's much easier to see headlines and images from actual disasters. Since help will be urgently needed, fund raising efforts have delays, spending has delays, and prevention is less interesting, the Red Cross may as well harvest whatever they can from this months leading news disaster and bank it to be ready to help with the next one. Many states have tax credits for some programs, which complicate federal taxes. A tax credit seems like a loan. We give a qualified charity money today, then when we do our taxes they give us a credit for the full amount(12). What about reducing your footprint? If you only eat ethically sourced eggs, or perhaps no animal products you are making a lifestyle sacrifice to benefit others(13). The cost of this life style might be lower, the same or more. The point is the intent to behave as a better person. When donating money there are a few other factors to consider about how well the funds will be used. Charity Navigator ranks charities by transparency and financial responsibility. For example Doctors Without Borders gets 4 of 4 stars by being highly ranked for both. March of Dimes only get's 2 stars for being transparent but poor use of funds. There is a meta cause called "80,000 hours" that help people starting careers to chose whether it makes more sense to earn more money to donate more, or to directly help people such as becoming a Red Cross doctor, or perhaps a cancer curing researcher. A similar meta effort is Charity Navigator, which tracks the quality of charities and is itself a charity asking for funds. Another tool is Givewell, which focuses more on effectiveness. Conceivably the most transparent and financially responsible charity doing something that doesn't actually help anyone wouldn't be the best thing to fund. Helping any of these make giving itself more effective is a 14th way to help. My perspective is that there are two things a person can do when they find themselves on the path to success. First, ignore anyone selling houses or cars. Second, seek to help people that will help others. Are you getting a little tired of your current car? If you won a historic lottery jackpot would buying a new car be near the top of the to-do list? I am not saying to never buy a new car but there are circles of wealthy people that consider it embarrassing to drive anything less than a new Bentley ($160,000 for the cheapest version and double that for the most expensive). Which brings up real estate. If you move to a mansion in a gated community of mansions you will see everyone driving new Bentleys. This is not directly philanthropy. However there is usually a sales tax. Even though involuntary your large purchase will include some amount that will be used to maintain roads, provide police help if your Bentley is stolen and so on(15). That mansion will require property taxes, which will fund local schools and other things (16), again mostly involuntary. Wealthy people that live in wealthy communities have a lower rate of giving than wealthier people in less affluent communities. Even if you gradually find yourself in this situation you are likely to feel two things. First the hedonic treadmill where what was once shiny and new feels worn and boring after a while. Marketing on every media outlet knows this and will encourage you to buy. The other factor is the peer pressure of keeping up with your neighbors status. Perhaps you don't need to be the flashiest person in town but do you want to be gossiped about by neighbors because your still driving an old car? However if you continue to live in a modest neighborhood where everyone has a modest car you can get something newer to you and still fit in without spending nearly as much. Imagine if everyone did this? Would a city where no one lives in a mansion or drives a Bentley be a horrible situation? What if the most successful people tried to compete with each other to help the least successful? Countries that try to force something like this with tax and legal codes tend to end up worse off. It would be far better for more people to chose to act like the great Chuck Feeney. He started from nothing and made Billions, then decided the billionaire life style wasn't for him and spent rest of his life giving it away. The bulk of the recipients were new colleges in poor countries. Some of those people certainly went on to become philanthropists themselves. He would find partners that would donate to a school if they could have a building named after them (17). Helping animals and other causes may be worthy. Especially preventing lost habitat and extinctions since recovery may take centuries or never. Some of these are urgent. Helping people that will go on to help other people (or animals) can have more of an exponential effect given time. In most cases these are still classic organizations focused on giving, with a mix of volunteers and paid employees. Imagine you save one plot of forest for $1M. You could even set up a trust fund with another $1M to pay legal and other caretakers to ensure it stays untouched in perpetuity. If there are unique animals in that forest this has a direct benefit to future life. Alternatively what if you used the $2M as a college trust fund helping like minded students get environmental law and science degrees? Such a fund could pay out 5%, or $100,000 a year indefinitely and still grow with inflation if prudently invested. That might be enough to fund 2 students a year. Those students may not just directly do good with their careers, they may make enough money to retire early and donate to other worthy causes. Making your own perpetual trust is an 18th way to give. A 19th way to give is to consider your investments. The baseline portfolio will usually have the S&P500 or broader stock market fund. However this includes tobacco companies giving people lung cancer, Halliburton making ammunition to kill people, Volkswagen faking data to make us breath more pollution, and many other companies with harmful business models. There exist socially responsible Investing (SRI) funds such as the Vanguard FTSE Social Index Fund and others. These exclude the worst companies but otherwise have the same broad fund of stocks to get the most diversification for the least cost. The more people that can live below their means, even as they grow their means, will free up funds to help more people. Those people can then help more people. These are exponential seeds. Another consideration to give money you might have a match through your employer. If your employer offers this then making the most of it will amplify your giving. Any time you give with a match is amplified for a 20th way to give. A final major consideration is children, and to a lesser extent, pets. From your countries long term point of view when someone raises a child they are creating a new tax payer that will pay into healthcare, welfare, senior care, state taxes, county taxes, and city taxes. This may be delayed a couple of decades but, in general, most will provide healthy productive decades long before they start to draw on the system. If a couple has 2 children in their life time they have broken even to produce enough to cover their own needs. People with zero or one are not contributing as much as they will be taking when older. Those raising 3 or more kids are doing more than their fair share. A common misconception is the old Malthusian argument that human overpopulation causes societies to collapse. To be fair this was true up to his time in the 1800s. What he could not have foreseen was a shift to a world where higher populations make the cost of everything much lower through economies of scale and technology. At the time slaves and non slaves worked long hours growing food and still starved occasionally while today hardly anyone works in agriculture and obesity is the fastest growing health problem everywhere, including in India and Africa. Japan has been in a decades long recession due to the lack of children, the US and other countries are on track to follow. While pets do not pay taxes and have shorter lives they are still an expense that has an altruistic component. If you adopt from a shelter you are often saving a life, especially an older or special needs dog or cat. This expense could have been sent to a charity, but you would miss out on the Oxycontin health benefits. You get this with children as well but they are more expensive and time consuming. One can have children, or pets, or both or neither so lets count this as ways 21 and 22. Overall perhaps it's best for people inclined to raise children to raise them to be charitable modest spenders, like themselves. Who will then go on to do the same. Those without children presumably have more time and money to do more good. Presumably about an extra $250,000 each and about 15 hours a week that could have gone into a side business or overtime working for a promotion. Let's say that nets another $250K for an even $500K per child. To simplify assume 2 children for 2 people so this is $500K per person. If one can be happy with $80,000 a year and pull 4% a year from investments they need $2M invested. To make up for not having children that extra $500K could pay out another $20K a year to do other good things. Someone earning $100K and living on $80K of it is giving 20% to charity. The bottom line is people with 2 kids can skip philanthropy if they like. They have already "paid their dues". Those without kids may consider aiming to retire with enough to give away another 20% to make up for not having kids. I suppose this means a couple that has 1 kid may each consider retiring when they can support themselves and give away 10%? There are those with health problems who can't have kids and also struggle to make even basic incomes and may be a net beneficiary of society. There are also those with high energy levels, clear minds and luck that that have several kids and still give billions to charity (Charles Feeney and others). This article is for those of is with average or better health, average or better judgment, and average or better luck. We could live more lavishly and help no one. We could live like paupers and help more. We chose to live a balanced life well enough within our means to help ourselves enough and some others who need it most. We can always find more ways to spend more money, and this is highly recommended by everyone working for sales commissions! While this may be ok to some extent there are other things that can be done with more income. Some of those things directly help ourselves at the same time, some things indirectly help us, and other things help others without a benefit. Some philosophers say if the act of giving feels good then you still get a benefit. I'm fine with that. If buying a larger, newer car makes me happy; and donating the money that could have paid for the larger car makes me happy, then I might as well help someone needier than a car dealer. So that makes 22 ways to give! Did I miss any? Please leave a comment. Further Reading (or playing) Here is a gameified quiz to help think about your approach to choosing what to fund: https://mygoodness.mit.edu/quiz https://www.mentalfloss.com/article/56264/what-do-girl-scouts-do-all-cookie-money https://www.cnbc.com/2018/06/04/these-states-offer-an-attractive-tax-credit-for-charitable-residents.html https://www.scientificamerican.com/article/why-malthus-is-still-wrong/ https://www.nytimes.com/2018/01/27/world/africa/kenya-obesity-diabetes.html https://www.philanthropy.com/article/Rich-Enclaves-Are-Not-as/156255 https://www.mrmoneymustache.com/2011/10/22/what-is-hedonic-adaptation-and-how-can-it-turn-you-into-a-sukka/ https://www.businessinsider.com/japan-demographic-time-bomb-reversing-but-us-is-in-danger-2018-7 https://www.hillspet.com/pet-care/behavior-appearance/why-humans-love-pets https://smartasset.com/retirement/the-average-cost-of-raising-a-child https://qz.com/work/1324454/how-parents-spend-their-time-when-theyre-with-their-kids/ https://www.prnewswire.com/news-releases/the-harris-poll-releases-annual-reputation-rankings-for-the-100-most-visible-companies-in-the-us-300222052.html https://assetbuilder.com/knowledge-center/articles/socially-responsible-index-funds-no-guns-cigarettes-or-sky-high-carbon-footprints https://www.charitynavigator.org/index.cfm?bay=search.summary&orgid=3628 https://www.charitynavigator.org/index.cfm?bay=search.summary&orgid=4045 https://www.givewell.org/ https://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.25.2.157 The ebook received over 400 downloads from the Amazon Kindle site!

|

AuthorA.A. Wyand Archives

January 2020

Categories |

RSS Feed

RSS Feed